HOW TO CLAIM CHILD BENEFIT: Are you responsible for any children under 16 years old?

In some cases, the eligibility criteria for claiming increases up to 20 years old. But, the child must be age 16 to 19 in approved education or in work training.

In all claims, only one person is eligible to get Child Benefit payments.

All claimants are responsible for reporting any change in their personal or household circumstances. You must report all circumstantial changes to the Child Benefit Office.

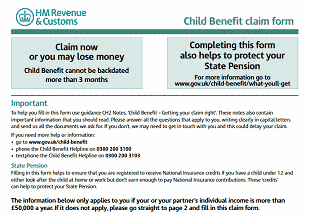

Having a high income may force you to pay a tax charge if you or your partner’s individual earnings are more than £50,000.

Those who are eligible can choose not to receive the monthly payments. But it is best to fill in the Child Benefit claim form anyway, because:

- It helps to get National Insurance credits which count towards the UK State Pension.

- It ensures the child registers for a National Insurance number when they reach 16 years old.

Claiming Child Benefit 2 Child Rates

There are two Child Benefit rates 2022. The amount you will get depends on which one you are eligible for.

- £21.80 a week: This allowance is for the eldest or the only child.

- £14.45 a week: This allowance is per child for those with additional children.

Important: You must contact the Child Benefit Office if you receive too much (e.g. get an overpayment) or if you get paid too little.

Guardian’s Allowance

There is also a Guardian Allowance for those who are bringing up someone else’s child. The payments would help when one or both parents have died.

The Guardian’s Allowance gets paid on top of any Child Benefit entitlement.

Joining or Separated Families

What happens if a family separates (splits up) or joins together?

In this case you should receive £21.80 a week for the eldest child that you already qualify for.

In other words, if your family splits up and you have two children, if one child stays with you, you will get £21.15 a week for that youngster.

Likewise, your ex-partner should also receive the same amount (£21.80 a week) if they make a benefit claim for the other child.

Note: Only one of you will receive Child Benefit if you both claim for the same child.

Child Benefit Additional Child: Families Joining Together

What about circumstances where two families join together? The eldest child in the new family qualifies for the £21.80 rate. You should get the standard rate of £14.45 for each providing you get entitlement to Child Benefit for additional children.

Check Child Benefit Payments

There are standard rules for Child Benefit payment dates. They usually get paid into ‘one‘ bank account every four (4) weeks and most often on a Monday or Tuesday.

Note: Single parents, or those receiving certain other benefits like Income Support, may get weekly payments instead. Remember family allowance payments over bank holidays are usually sent out early.

There are rules about account holder names for payments. Guidance notes on the Child benefit form online UK clarify whose name can be on the bank account for payments.

Even so, money cannot get paid into a Nationwide cashbuilder account (sort code 070030) if it is in the name of another person.

High Incomes: Over £50,000

You may incur a tax charge, called the ‘High Income Child Benefit tax charge‘ if you or your partner’s individual income is more than £50,000.

You can use the Child Benefit tax calculator to estimate how much tax you may have to pay.

The tax charge means you may still be eligible for Child Benefit even if you choose to stop receiving it. This applies even in certain situations where you or your partner has an income over £50,000.

Stopping your Child Benefit payments does not affect your entitlement. You can always change your mind and restart them. The Child Benefit Office has more information about your eligibility.

Benefit Cap

The government Benefit Cap limits the amount of benefit that most people can get between the ages of 16 to 64. Some individual benefits are not affected. But, it may affect the total amount of benefit you have entitlement to and receive.

How Child Benefit Helps Your State Pension

Claiming Child Benefit online can help you qualify for National Insurance credits if your child is under 12 and you are not working. The same applies if you are not earning enough to pay National Insurance contributions.

National Insurance credits count towards your State Pension. They also protect it by helping to make sure you do not develop gaps in your National Insurance Record.

Eligibility Rules for Child Benefit

According to the eligibility rules for claiming Child Benefit, only one person can receive the payment. If you are responsible for a child under 16 (or under 20 if they stay in approved education or training) and you live in the UK, you would normally qualify.

Being ‘responsible for a child‘ means you live with them or you are contributing towards looking after them. The contribution amount should be at least the same as Child Benefit (or the equivalent in kind).

As a rule contributions include:

- Money (or pocket money)

- Food

- Clothes

- Birthday and Christmas presents

Note: The payments continue for a further twenty (20) weeks if a 16 or 17 year old leaves education or training. But, Child Benefit extensions only apply if they register with the armed services or a government-sponsored careers service.

The usual Child Benefit eligibility criteria also changes if:

Adoptions and Fostering

The process for adoptions and fostering means you can apply for Child Benefit online as soon as any adopted child comes to live with you. There is no need to wait until the adoption procedures are complete. The nationality of the child does not affect your claim for entitlement.

In some circumstances you may get Child Benefit for a period before the adoption. Contact the Child Benefit Office to find out.

You will still get Child Benefit if you foster a child. That is providing the local council is not paying towards their accommodation or maintenance.

Caring for Someone Else’s Child

You may still qualify if you have an informal arrangement to look after the child of a friend or relative – providing your council is not paying towards the child’s accommodation or maintenance.

You may have entitlement to the Guardian Allowance if you are responsible or caring for a child who has lost one or both of their parents.

Living Abroad: Claim Child Benefit UK

You may Claim Child Benefit online even if you go to live in certain countries outside the UK or if you are a Crown servant.

Moved to the United Kingdom

Claiming Child Benefit online may also get approved if your main home is in the UK. That is providing you have permission to live in the United Kingdom.

Child Benefit Helpline

Telephone: 0300 200 3100

Welsh language: 0300 200 1900

Textphone: 0300 200 3103

Outside the UK: +44 161 210 3086

Monday to Friday: 8am to 8pm

Saturday: 8am to 4pm

Call costs in United Kingdom

When Child Benefit Stops

Many people wonder ‘when do Child Benefit payments stop‘. Your Child Benefit stops immediately if your child starts work or gets benefits in their own right. Examples can include when they start:

- Paid work for 24 hours or more a week and is no longer in approved education or training.

- An apprenticeship in England.

- Getting certain benefits in their own right (e.g. Employment and Support Allowance, Income Support, or Tax Credits).

Claim Child Benefit Online Form CH2

The first step is filling in the Child Benefit claim form CH2. Then send it to the Child Benefit Office address with your child’s original birth or adoption certificate.

Click here to use the on screen version of ‘Child Benefit claim form CH2‘. The same link will also give you access to ‘Child Benefit claim form: additional children (CH2 (CS))’ PDF version.

Child Benefit Office (GB)

Washington

Newcastle Upon Tyne

NE88 1ZD

Important: You can still make a claim to receive Child Benefit in the United Kingdom even if you cannot register the birth of your child due to the coronavirus outbreak (COVID-19).

The process can take up to 12 weeks, especially for a new claim. It may take even longer if you are relatively new to residing in the United Kingdom. So, the best advice is to start the claims procedures as soon as your child is born or comes to live with you.

Child Benefit can get backdated for up to 3 months.

Send in your claim form even if you are not in possession of the birth or adoption certificate. That’s because you can send in the certificate later when you have it.

The birth or adoption certificate is not required if you have claimed Child Benefit before and are making a new claim for the same individual. But, you can order a new birth or adoption certificate if you lose the original.

Note: If you are claiming Child Benefit for someone else you may be able to manage another person’s claim.

CHB Help and Information

Change in Personal Circumstances

You must report changes in your personal circumstances to the Child Benefit Office. Circumstantial changes may include:

- Those which affect your family life (e.g. you get married).

- Those which affect your child’s life (e.g. they leave education or training).

Complaints and Appeals

Clients who are unhappy with the service or treatment received may complain to the Child Benefit Office. Further help and information is always available by contacting the Child Benefit Office.

There is a different process to follow if you disagree with a decision. In this case you should appeal to the Social Security and Child Support Tribunal. But, in most cases you should ask for a mandatory reconsideration before you appeal.

Note: The short video clip [1:20 seconds] explains more about DWP Child Benefit eligibility and how it works.