Changing Car Tax Class

Table of Contents

Certain kinds of vehicle alterations affect the rate of duty you need to pay. Some of the common vehicle changes that affect tax can also affect vehicle tax rates and its taxation classification.

So, you will need to change vehicle tax class with the DVLA any time you make modifications that affect the:

- Vehicle engine size (cylinder capacity) or the type of fuel it uses.

- Revenue weight of a heavy goods vehicle (HGV).

- Number of seats on a bus.

- Main use of the vehicle (e.g. start charging passengers in a minibus).

Note: Depending on the year of manufacture, certain types of historic (classic) vehicles are exempt from Vehicle Excise Duty (VED).

You will need to supply DVLA with a payment method to change taxation class. They may also need some extra documentation for vehicle tax change. The specific application forms needed will depend on the type of vehicle you have and several other factors.

As a rule, vehicles exempt from road tax (or paid at a lower rate) will be when they are used by (either):

- A disabled person.

- An organisation that provides transportation for disabled people.

Important: Making a false declaration about road tax exemption is a criminal offence which can result in a fine or imprisonment.

Forms Used to Change Vehicle Tax Class

There are several ways to change car tax class (using different forms). The correct method for changing taxation classification will depend on whether:

- The road tax is not due to expire (run out).

- The road tax is due to expire (e.g. you received a reminder or ‘DVLA last chance warning letter‘).

- The vehicle is exempt (e.g. you are changing car tax from disabled to normal).

Note: Check the sections below to find out when to use DVLA V70 form and when it must be the V62 tax class form at the Post Office. There are some differences to the way you would normally tax your vehicle (e.g. car or motorcycle).

How to Work Out the New Vehicle Tax Rate

Follow these five simple steps to work out whether the change made to your vehicle will mean you need to pay more tax.

- Use the vehicle tax rate tables to determine the new rate of Vehicle Excise Duty (VED).

- Then you need to calculate the difference between the old and the new rates of your current vehicle tax. For example, if the old rate is £200 and the new rate is £260, then the difference would be £60.

- The next step is to divide the difference by the number of months you pay tax over. For example, £60 divided by 12 months is £5.

- Then multiply this by the number of months that remain on the tax. For example, 5 multiplied by 6 months is £30.

- Having calculated the new rate you must then pay the extra vehicle tax. In this particular example you would need to pay £30 extra tax.

If Vehicle Tax Rates Increase or Decrease

If the Rate Increases

If the calculation shows the tax rate increased you would need to pay the higher rate from the first day of the month in which you change the tax rate.

An example:

Suppose you buy a car with disabled tax and you change car tax class from disabled to normal (e.g. private or PLG) on the 25th of March. Because you will remove disabled tax from a car you would have to pay the increased rate from the 1st of March (the start of that particular month).

If the Rate Decreases

If the calculation shows the tax rate decreased you would need to pay the lower rate from the first day of the following month.

An example:

Suppose you change car tax class to disabled classification on the 25th of March. If so, you would pay the decreased rate from the 1st of April (the next month).

Note: The short DVLA video [2:24 seconds] explains how to pay vehicle tax by Direct Debit online or at a Post Office branch that deals with vehicle tax.

Change Tax Class (Not Due to Run Out)

Use the V70 form to change vehicle tax class providing the tax is not close to running out. But, you should use a different method if you already received a reminder letter or the ‘last chance’ warning letter (see below).

Fill in and send a V70 form ‘Application to change vehicle tax’ to the DVLA along with:

- The V5C vehicle registration certificate (log book) with any new changes marked on it.

- Your payment method (either a cheque or postal order) if you need to pay extra. Make it payable to ‘DVLA, Swansea’.

- A valid MOT test certificate (where applicable).

- Written evidence of the changes made if you decrease the engine size or you changed the type of fuel it uses. Examples can be a receipt for a new engine or a letter of proof from the garage that made the alterations.

- Changing vehicle taxation class in Northern Ireland would also require you to send an insurance certificate or a valid cover note.

Important: Do not send the V70 form to the Post Office. You can only apply to change your vehicle’s tax class with the DVLA.

DVLA

Swansea

SA99 1BF

Frequently Asked Questions

You can carry on using your car while the Driver and Vehicle Licensing Agency (DVLA) process changes in taxation classification.

- The DVLA will confirm the change of vehicle tax class within ten (10) working days.

- They will follow that by sending you the updated V5C registration certificate.

- It takes around six (6) weeks to receive a vehicle tax refund if one is due. Nonetheless, after waiting six weeks, you should contact the DVLA if it does not arrive.

Note: What if you do not have the V5C logbook? If not, you should use the DVLA form V62 ‘application for a vehicle registration certificate’ instead. Send the V62 tax class application with the £25 fee to DVLA Swansea SA99 1DD.

Change Vehicle Tax Class (Due to Run Out)

In some cases, you will have to change car tax class at one of the Post Office branches that deal with road tax. It will be necessary if:

- The road tax is due to expire (e.g. you received a reminder or ‘DVLA last chance warning letter‘).

- The change relates to whether a vehicle is exempt from vehicle tax or not (e.g. you are changing car tax from disabled to normal PLG).

Note: People with a disability may be eligible for a vehicle tax reduction. In this case, you would need to apply by post to the DVLA instead.

Frequently Asked Questions

You can continue using your vehicle while the Driver and Vehicle Licensing Agency (DVLA) process the relevant changes in taxation class.

- The Post Office will send your documents, either the V5C, V5C/2 (new keeper slip), or the V62 tax class to the DVLA.

- The DVLA will send confirmation to you within ten (10) working days confirming the changes.

- The next step is for the DVLA to send you the updated V5C registration certificate.

- It takes around six (6) weeks to receive a vehicle tax refund if one is due. Nonetheless, after waiting six weeks, you should contact the DVLA if it does not arrive.

Change Vehicle Tax Class at Post Office

What if you are missing your DVLA V11 reminder letter or the V5C registration certificate? You can still pay for vehicle road tax at certain branches of the Post Office®.

The documentation that you would need to take, includes:

- The V5C vehicle registration certificate (log book) in your name. Use the new keeper supplement V5C/2 if you recently bought it.

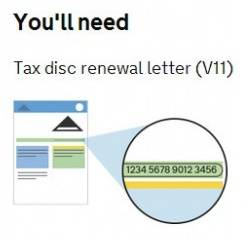

- The DVLA vehicle tax reminder letter (V11) (if you have it).

- A valid MOT test certificate from when the tax starts. Take evidence if your vehicle is exempt from an MOT (V112).

- Your proof of any eligibility for a disability exemption (or road tax reduction) for vehicles and transport.

- Changing vehicle taxation class in Northern Ireland would also require you to send an insurance certificate or a valid cover note.

Note: You can also apply for tax class V62 registration certificate at the same visit. The V62 application form is available at any vehicle tax Post Office branch and the cost is £25.00.

DVLA Change Tax Class Lorries and Buses

To change the tax classification of a Lorry or a bus, besides the usual documentation, you will also need to produce:

- A plating certificate or changed weight certificate (read specialist tests for lorries for more details).

- A Certificate of Initial Fitness (COIF) or a Certificate of Conformity (CoC) for the bus taxation class only (where needed). In some cases the equivalent PSV401, PSV408, PDV500, or PSV506 will meet the requirements.

- A Reduced Pollution Certificate (RPC) for vehicles in tax class HGV or a Low Emissions Certificate (the RPC scheme ended on the 31st of December 2016).

Note: A different section has further information and guidance on how to manufacture or adapt a vehicle (e.g. getting vehicle approval).

Change Tax Class HGVs (Due to Run Out)

If the road tax is due to run out, to change the taxation classification of a goods vehicle over 3500kg (e.g. a lorry or a bus) you will also need to send:

- A Reduced Pollution Certificate (RPC) for vehicles in tax class HGV or a Low Emissions Certificate (where applicable).

- A current and valid certificate showing the annual test (MOT) for lorries, buses and trailers for the vehicle.

Note: You can also use the exemption from heavy goods vehicle (HGV) annual testing (form V112G) if the vehicle requires it.