NI RECORD FOR STATE PENSION: As a rule, you will need to have ten (10) ‘qualifying years‘ to receive the minimum State Pension.

But, even if you qualify for the full State pension, you may receive less if you ‘contracted out’ before the 6th of April 2016.

Under the ‘old rules’, you may get more than the new State Pension. It depends on the amount of ‘Additional State Pension‘ you paid into the old pension scheme.

As a rule, 35 qualifying years is necessary to get the full new State Pension.

Note: That is important if you do not have a National Insurance record before the 6th of April 2016.

NI Qualifying Years when in Work

If you work and pay NI contributions, you qualify for a year credited on your National Insurance record providing:

- You earn £190 or more per week from a single employer.

- You are paying Class 2 NIC as a self-employed person.

The working year runs from the 6th of April to the 5th of April in the following year. If you are earning less than £190 a week you may not pay National Insurance contributions.

Note: There are some exceptions to this particular rule if you earn between £123 and £190 a week from a single employer.

NI Qualifying Years if Not in Work

As a rule, you have entitlement to National Insurance credits even if you are unable to work. Reasons for this can include illness, disability, or being a full time carer. You can still get credits even if you are not employed, but you must be ‘signed on’ and ‘actively’ looking for work.

Other examples for getting National Insurance credits include:

- Receiving Child Benefit for a child under the age of 12. There is an exception to this rule is if the child was under 16 before the year 2010.

- Getting the Jobseeker’s Allowance, Employment and Support Allowance, or the Carer’s Allowance.

Not in Work: Not getting National Insurance Credits

If you are not paying NIC you may be able to make Class 1 voluntary National Insurance contributions. These will get added to your NI record and you will receive a higher State Pension when you retire.

Gaps in National Insurance Record

Often, you can still get the full new State Pension even if you have gaps in your National Insurance record. There is a way to get a State Pension forecast of how much you might get.

Note: Select the ‘State Pension statement’ after signing in to the Government Gateway.

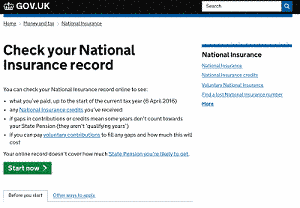

To check if you have gaps in your NIC record you can also apply for a National Insurance statement. HM Revenue and Customs provide the online form via the Government Gateway system.

Having gaps in your National Insurance record prevents you from getting a full new State Pension. But, you may be able to ‘top-up’ your record by:

Been in a Workplace, Personal, or Stakeholder Pension

You might have some deductions taken off your ‘starting amount‘ if you were in:

You might have some deductions taken off your ‘starting amount‘ if you were in:

- An earnings-related pension scheme at work before the 6th of April 2016. This includes a career average or a final salary pension.

- Personal, stakeholder, and workplace pension schemes before the 6th of April 2012.

If you paid into one of the above schemes you most likely paid lower National Insurance contributions. This is also known as ‘contracting out’ of the Additional State Pension. This is true for most people who have been in work.

Check with your pension provider to see if you have previously been ‘contracted out‘. What if you do not know your pension provider or have lost their details? You should contact the Pension Tracing Service to see if they can help you find them.

Contracting Out after April 2016

Some of the pension rules and regulations changed on the 6th of April 2016. Thus, if you were ‘contracted out’:

- You are no longer contracted out.

- You will pay a higher rate of National Insurance (the standard rate).

Contracted Out Check

One way to find out if you were ‘contracted out’ is to check your old payslips. If your National Insurance category has either a D or N – you contracted out. If it has the letter A you were not contracted out.

Note: Check with your employer or pension provider if there is any other letter.

As a rule, if you worked in the public sector you would have been ‘contracted out’. Typical examples include:

- Local council worker

- State School teacher

- The fire service

- The civil service

- The National Health Service

- The police force

- The armed forces

Note: Thus, being contracted out means you would have paid a lower rate of National Insurance contributions.

ALSO IN THIS SECTION

New State Pension: A section explaining the new State Pension rules and regulations.

State Pension Formula: Your NI record determines how the new State Pension gets calculated.

Inheriting or Increasing: The rules for State Pension payments after the death of a spouse (or partner).

Living and Working Abroad: What happens to your new State Pension if you live and work overseas?