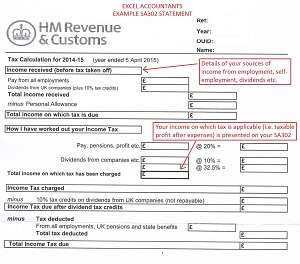

SA302 FORM: It is important for the self employed to understand how to get their tax year overview.

As a rule, you will need the SA302 document if you apply for a mortgage. It is a method self employed people use to prove their earnings to the mortgage lender.

You get the last 4 years’ evidence of earnings using HMRC SA302 form. It also provides a tax year overview for any previous trading years.

But, you must have sent in a Self Assessment tax return to be able to print or request the calculation summary.

Most people working for themselves know the tax year starts on the 6th of April and ends on the 5th of April after it. So, for each of your self employed tax years you may be able to:

- Get HMRC document SA302 sent to you by postal methods.

- Get a print of the tax calculation document yourself (if you submit a Self Assessment tax return online).

How to Print Off SA302 Online

There are 2 methods of printing off the HMRC tax calculation summary document. The same applies to getting an overview of your tax year. But, to do so you must be filing your Self Assessment tax returns using either:

- Accepted commercial software for Self Assessment tax returns.

- HM Revenue and Customs ‘Government Gateway Account’ online services.

Note: Check if your mortgage provider will accept your own printed tax document. You must wait 72 hours after sending in a tax return to print HMRC SA302 Form.

Using HMRC Online Services

- Log in to your GOV.UK Verify or Government Gateway account.

- Select ‘Self Assessment‘.

- Then select ‘More Self Assessment details‘.

Using Commercial Software

Many self employed people and accredited accountants use commercial software tax returns. You can use the same software to print off a tax calculation.

Note: The software program sometimes call it something different (e.g. tax computation). Contact the software company if you have trouble making a printed copy. You can still print a tax year overview from your own HMRC online account.

SA302 Tax Calculation Form Sent by Post

There may be times when you need your documents sent to you by post. In this case contact HM Revenue and Customs to get a tax calculation or tax year overview sent by posting. HMRC will post SA302 Form to you if:

- You are self employed and do not have access to a printing machine.

- You are self employed and sent in your tax return by postal methods.

- Your mortgage provider will not accept documents printed off by your own means.

Note: It may take up to two weeks to get the document send when HM Revenue and Customs send it by mail.