APPEAL A TAX PENALTY: Typical reasons for HMRC to issue taxation penalties include:

- Failing to keep adequate taxation records.

- Sending an inaccurate tax return to HMRC.

- Sending late returns to HM Revenue and Customs.

- Making late payments on direct or indirect taxes.

In some cases you can make an appeal to HM Revenue and Customs against these types of tax penalties.

If you make an appeal, one of the officers at HMRC will carry out the penalty review. It will not be the same officer who was already involved in the penalty decision.

A different process applies when appealing against a penalty on ‘indirect taxes‘. Some examples of indirect tax include Value Added Tax, customs duty, and excise duty. You would need to request a review by HMRC or in some cases you can appeal direct to the tax tribunal.

Note: HM Revenue and Customs may cancel or amend a tax penalty if you can provide a reasonable excuse.

How to make a Penalty Appeal

You may get the HMRC penalty appeal letter sent to you by post. If so, there will be an appeal form attached to the documentation. You should follow the guidelines and instructions written on the penalty appeal letter.

But, you should use is a different process for VAT, Corporation Tax, Self Assessment, and PAYE. There may be extra documents to use or you can use an alternative way to make a penalty appeal.

HMRC Self Assessment Penalty Appeal

Those who are appealing a Self Assessment penalty will need to provide:

- The date when the penalty got issued.

- The date when you filed the Self Assessment tax return.

- Some details of a ‘reasonable excuse’ for late filing.

Appeal a Tax Penalty Online

As a rule, there is a £100 penalty for filing a late return for the previous tax year. In these cases, you can appeal against a tax penalty online.

As a rule, there is a £100 penalty for filing a late return for the previous tax year. In these cases, you can appeal against a tax penalty online.

You would need a Government Gateway account unless you already have one set up. If not, you can use HMRC Self Assessment appeal form SA370. You can also send a letter direct to the HMRC contact address for Self Assessment enquiries.

HMRC also charge penalties to business partnerships for sending late tax returns. In these cases, it is only the ‘nominated’ partner who can make a penalty appeal. Use Form SA371 ‘Partnership Tax Return appeal against late filing penalties’.

Note: Before appealing a tax penalty you must have already sent in the Self Assessment tax return. Contact HM Revenue and Customs and inform them if you do not need to complete a return.

Appealing PAYE Penalties

Use the HMRC PAYE for employers’ service to appeal online. Select ‘Appeal a penalty‘ after logging in to the system. Once you submit your appeal the program will give you an immediate acknowledgment.

Filed Late Corporation Tax or VAT Return

The GOV.UK website has some specific forms and guidance for situations that include:

- Use Form WT1 Corporation Tax penalty appeal (if computer problems was the cause of filing late).

- Use Form WT2 Value Added Tax penalty appeal (providing there were reasonable excuses for late filing).

Tax Penalty Appeals without an Appeal Form

There is no requirement to appeal a tax penalty online. You can choose to send a signed letter to HM Revenue and Customs instead. Send the claim to the same HMRC office dealing with your return. But, the letter must include these details:

- Your full name and your reference number (for example):

- Self Assessment

- Unique Taxpayer Reference (UTR)

- VAT registration number.

- An explanation (in full and including dates) of why the payment (or return) was late.

Note: Include the date you tried to file or make a payment online if it was due to computer problems. Add any relevant details of a system error message if you have one.

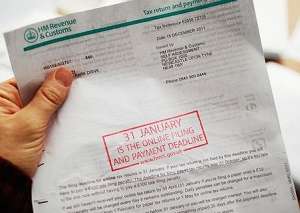

Tax Penalty Notice Deadlines

The deadline for tax penalty appeals is 30 days from the date of the tax penalty notice. You need to give a valid reason if you miss the 30 day deadline. HMRC will then decide whether to consider your request for appeal.

Dispute HMRC Penalty Review

There are several steps to take if you disagree with the review made by HM Revenue and Customs:

- Ask for the tax tribunal to hear your appeal. This must occur within 30 days of the original review decision.

- Consider using alternative dispute resolution to find a solution. The Alternative Dispute Resolution (ADR) is a different method of dealing with tax disputes with HM Revenue and Customs.

Note: Being in debt can be a trigger for stress, depression, and anxiety for many people. Further information about the relationship between tax debt and mental health is available on the RIFT website.