Do You Need to Pay Workers through PAYE?

The first step is working out whether your new starter will be an employee or a self-employed worker. As a rule, they will be:

- In employed status if they will be working for you and have none of the risks associated with running the business.

- Classed as self-employed if they are running their own business and have the responsibility for its success (or failure). Employers do not need to pay any self-employed workers through PAYE.

You must check whether you need to pay someone through a ‘Pay As You Earn’ scheme. Getting it wrong means you could end up paying extra tax and National Insurance (including interest and a financial penalty).

In most cases, you need to pay your employees through PAYE if they earn at least £123 a week, £533 a month, or £6,396 per year.

Important: There are seven important steps to consider when employing people for the first time (e.g. making sure they are eligible to work in the United Kingdom).

Taking On Temporary or Agency Workers

Some temporary workers will be classed as ’employees’. Hence, you must operate PAYE for any temporary staff that you pay ‘directly’ (e.g. not paid by an agency).

But, you would still need to operate PAYE if their agency is based overseas and does not have a trading address (or a representative) in the United Kingdom.

Note: Special rules apply for employers paying casual employees (e.g. two weeks or less) for working outdoors harvesting perishable crops, or as casual beaters for a shoot.

PAYE for Employees Paid Only One Time

The way you operate PAYE differs for employees that you only pay once. You need to set up a payroll record in the normal way (e.g. with their full name and address) and use a unique payroll ID (if you issue one).

But, when you send a Full Payment Submission (FPS) to HM Revenue and Customs (HMRC), you should:

- Use tax code ‘0T’ on a ‘Week 1’ or ‘Month 1’ basis.

- Insert ‘IO’ in the field titled ‘Pay frequency’.

- Leave the start or the leaving date blank.

Employees you only pay once do not get a P45. Instead, you would need to give them a statement that shows:

- Their pay (before and after deductions).

- The payment date (e.g. a payslip or a written letter).

PAYE on Volunteers

Often, volunteers only get expenses not subject to tax or National Insurance. If so, there is no need to operate PAYE on them.

Note: You should be operating PAYE on students in the same way as you would be doing for workers classed as employees.

Getting Key Employee Information

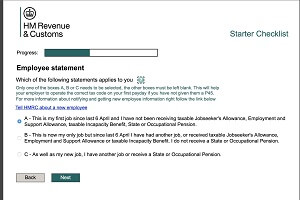

As an employer, you must get some personal information from your employees to set up your payroll software. It is important to set them up with the correct tax code and starter declaration, by getting their:

- Date of birth (and gender)

- Address

- Start date

You can get other information about a new employee from their P45, such as their:

- Full name

- Leaving date from their previous job

- Total pay and tax paid to date (for the current tax year)

- National Insurance number

- Existing tax code

- Student loan deduction status (if applicable)

Another section explains PAYE and payroll for employers in greater detail. But, you need to keep the information in your payroll records for the current year and for the following three (3) tax years.

Note: The new ‘PAYE starter checklist‘ replaces the outdated P46 form (which is no longer used). So, you can use it to gather the correct information about a new employee if your employee does not have a P45.

What if Your New Starter has Several P45s?

If your employee has more than one P45 you will need to use the one with the most current date. Remember to return the others back to your employee.

What if the P45s have the same leaving date? In this case, you would need to use the one with the highest tax free allowance (e.g. the least additional pay for K tax codes).

How to Work Out a New Employee’s Tax Code?

There is an online tool to help you work out your new employee’s tax code and starter declaration. You can also use it to check what needs doing before paying a new employee for the first time.

Note: Different rules apply when working out tax codes for employees you only pay once (details above) and for new employees coming to work from abroad (e.g. secondments from outside the United Kingdom).

Making Student Loan Repayments

After telling HM Revenue and Customs about a new employee, you would also need to start making student loan deductions from their pay, if their P45 shows that deductions should continue, or:

- The new employee informs you that they are repaying a student loan or a postgraduate loan (e.g. on a starter checklist).

- You get form SL1 or form PGL1 from HMRC and your employee is earning more than the income threshold for their student loan.

Other Important Steps:

No matter whether your employee has a P45 from their last job (or not), you should also find out if they have a student loan or a postgraduate loan.

Follow that by recording their answer to this question in your payroll software. It will then be able to calculate student loan and postgraduate loan recovery from their pay.

If your employee has a student loan, ask them to check with the Student Loans Company which plan should be used for deductions. It will either be Plan 1 or Plan 2.

You would need to record Plan 1 in your payroll software until you get a student loan start notice (SL1) if they are unable to tell you.

Note: Reporting these types of deductions to HM Revenue and Customs are part of your regular payroll tasks as an employer.

Special Rules:

HMRC provides further guidance on making employees’ student loan and postgraduate loan (PGL) deductions for several different circumstances, including cases where you:

- Receive a court order to collect a debt directly from the earnings of your employee.

- Change the frequency of pay for your employee (e.g. from weekly to monthly).

- Need to calculate your employee’s aggregated earnings because they have more than one job with you.

Stop Making Loan Deductions

You should continue making loan deductions from your employees’ pay until or unless HMRC tells you not to do so. In this case, they would send you (either):

- Form SL2 (to stop making student loans).

- Form PGL2 (to stop making postgraduate loans).

How to Register a New Employee

All employers need to tell HMRC about a new employee before they start receiving regular pay. You achieve this by registering their details on a Full Payment Submission (FPS) on their first payday.

The FPS should contain:

- Information that you already collected from your new starter.

- Employee tax code and starter declaration.

- Pay and deductions since they started working for you (not their previous job). In most cases, this will include tax, National Insurance, and any student loan deductions.

Assigning Payroll IDs to Employees

You must use a unique identification when giving your employee a payroll ID. Furthermore, you must also use a different payroll identification any time you:

- Employ someone that has more than one job in the same PAYE scheme.

- Re-employ the same person. You can restart their year-to-date information from ‘£0.00’ if it occurs within the same tax year.

Special rules apply when making deductions for certain types of unusual or unique circumstances, such as:

- Payroll for female employees who pay less National Insurance.

- Employees that you only pay one time (see above).

- Paying harvest casuals and casual beaters.

- Working out National Insurance contributions if your employee has more than 1 job.

Important: Re-using a previously used payroll ID means you will be creating a duplicate record and reporting incorrect payroll details.

Getting a Late P45 or Starter Checklist

There may be times when you need to update your payroll records. A typical example would be if your employee gives you a P45 or starter checklist after registering a new employee with HMRC.

Note: Starter checklists are only necessary if your new worker cannot give you a P45 or they left their last job before the 6th of April 2019.

What if HMRC Send You a Tax Code?

You may get a tax code from HMRC if your employee gives you a late P45 or starter checklist (e.g. after paying them).

If this happens, you should deduct any student loan repayments from the date that the employee started with you.

If HMRC Do Not Send You a Tax Code

If the P45 is Late

You can work out the tax code from your employee’s P45 and then update the relevant details in your payroll software.

But, if you take on a new employee who left their previous job after the 5th of April 2020 you should also update the fields titled:

- ‘Total pay to date’.

- ‘Total tax to date’

If the Starter Checklist is Late

If you get a late starter checklist from a new starter you should use it to update the starter declaration in your payroll records.

Then, continue using the same tax code that you already used in your first Full Payment Submission (FPS) until you get a new one from HM Revenue and Customs.

Note: Next time you pay your employee you must not enter another start date on the FPS. This also applies if you did not report a start date on a previous occasion.