There are several important tasks that employers can perform when using HMRC’s PAYE Online, including:

- Accessing tax codes and notices about your employees.

- Sending payroll reports to HM Revenue and Customs.

- Getting alerts from HMRC after reporting or paying late (or failing to send the expected number of reports in a month).

- Registering to receive email reminders (e.g. for alerts and notices).

- Appealing a penalty.

Some of the online services, such as signing into a Government Gateway account, may be slow during the busiest periods.

As a rule, you will get a unique login from HMRC after registering as an employer online. But, you will be able to enrol for PAYE Online separately if you already registered in a different way (see below).

Note: A guide explaining how to use the PAYE Online service is also available for employers in Welsh language (Cymraeg) via the GOV.UK website.

Sending Payroll Reports to HMRC

Employers can use the PAYE Online service to send certain types of payroll reports (e.g. expenses and benefits returns). You will need to enter your PAYE Online login details if your payroll software doesn’t allow you to make a direct report.

Note: Your HMRC online account allows you to view your current position (e.g. sent payroll reports, anything owed).

Viewing Tax Codes and Notices

HMRC uses the same PAYE Online service to send information about your employees. So, after logging in to your account you will be able to view:

- Tax code notices (e.g. P6, P9)

- National Insurance verification notices (e.g. NVR, NOT)

- Generic notifications (e.g. what to do if you get an online penalty warning message)

- Student loan notices (e.g. SL1, SL2)

Note: The PAYE Desktop Viewer (an application from HM Revenue and Customs) and certain types of payroll software allows you to view the same details.

How to Enrol Separately for PAYE Online

There is no need to make a separate enrollment for HM Revenue and Customs PAYE Online service if you already registered as an employer and have a login. But, you can enrol separately if you did not register online.

The way you enrol for PAYE online will depend on whether you already have an online account set up for other taxes (e.g. for Corporation Tax or for Self Assessment).

Note: HMRC will send you a letter that contains your PAYE reference and Accounts Office reference when they confirm your registration.

If You Already Have an Account

You can use your Government Gateway account to log in to HM Revenue and Customs Online Services. Then, enter your details by selecting the option to enrol for ‘PAYE for Employers’ found in the ‘Services you can add’ section.

If You Don’t Have an Account

You would need to enrol as a new user if you do not already have an account. Select ‘PAYE for Employers’ found in the ‘Organisation’ section and follow the instructions.

Downloading PAYE Desktop Viewer

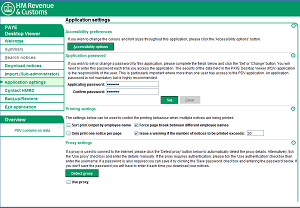

The HMRC PAYE Desktop Viewer is an application that allows employers to view, search, and sort through large numbers of employee tax codes and notices.

The main function of the PDV is being able to download notices and then view them offline. Hence, there is no need to access them through HMRC PAYE Online service (or payroll software).

The main function of the PDV is being able to download notices and then view them offline. Hence, there is no need to access them through HMRC PAYE Online service (or payroll software).

- Linux

- Mac

- Windows (excluding Vista)

You should download HMRC PAYE Desktop Viewer directly onto a desktop computer (not a server).

Note: The master section contains more information about PAYE for employers, running a payroll system, and keeping proper records for HM Revenue and Customs.