Tax Credits Payments

Table of Contents

As a rule, the UK Government send out tax credit payments every week. But, in some cases, you can get them paid into your bank as a regular deposit every four (4) weeks.

When you first start claiming tax credits, you can choose between getting paid on a weekly basis or as a monthly installment instead.

Here’s how it works:

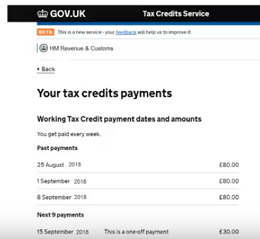

The tax credits payment table shows when to expect the deposit. Further information explains what happens with early payments and how to check the amount you will get paid.

Tax Credit Payment Dates Bank Holiday

| Child Tax Credits and Working Tax Credits Due Dates | Tax Credits Payment Dates 2022 |

|---|---|

| 5th of January 2022 | 4th of January (England, Northern Ireland) |

| 17th of March 2022 | 16th of March |

| 18th of March 2022 | 17th of March (England, Scotland) |

| 15th of April 2022 (Good Friday) | 14th of April |

| 18th of April 2022 (Easter Monday) | 14th of April |

| 2nd of May 2022 | 29th of April |

| 2nd of June 2022 (Spring Bank Holiday) | 1st of June |

| 3rd of June 2022 | 1st of June |

| 12th of July 2022 (Battle of the Boyne) | 11th of July |

| 13th of July 2022 (England, Scotland) | 12th of July |

| 1st of August 2022 | 29th of July |

| 2nd of August 2022 (England, Northern Ireland) | 1st of August |

| 29th of August 2022 (Summer Bank Holiday) | 26th of August |

| 26th of December 2022 | 23rd of December |

| 27th of December 2022 | 23rd of December |

| 28th of December 2022 | 23rd of December |

| 29th of December 2022 | 28th of December (England, Scotland) |

| 2nd of January 2023 | 30th of December 2022 |

| 3rd of January 2023 | 30th of December 2022 |

| 4th of January 2023 | 3rd of January (England, Northern Ireland) |

Note: As a rule, each payment follows the previous payment periodically. But it may get paid early if your next due date falls on one of the UK bank holidays 2022. The dates include Easter time or days during Christmas and New Year festive season celebrations.

Making a New Claim for Tax Credits

Processing a new claim for tax credits can take up to five (5) weeks. Once your claim is successful you will receive an award notice – a letter sent by post. The award notice informs you of the date for your first tax credits payments 2022.

You will only be able to make a new claim for tax credits if (either):

- You already get disability premiums (i.e. the severe disability premium).

- You received it in the last month and you still meet the eligibility criteria.

Note: Another section explains the steps to follow if you cannot make a new claim for tax credits.

DWP Tax Credits Paid Late

What if your Working Tax Credit or Child Tax Credits payment is late or not gone in the bank? In this case, you should check the payment date on your award notice. You could also contact your bank to check why tax credits have not been paid.

It is best to make these preliminary checks before phoning the tax credits helpline to get further advice.

Extra Tax Credits Payment 2022

It is not uncommon to get an extra tax credit payment. If so, the most likely reason for being paid twice is the renewal period at the end of the tax year. So, it could be money that HMRC owe you from the previous year.

Note: You may receive early tax credit payments if the due date is a bank holiday in United Kingdom.

Tax Credits Payment Dates 2022 Christmas

As a rule, tax credits bank holiday payments clear and get paid to beneficiaries a few days earlier, or later, than the actual payment date.

That means if you did not get paid on the due date, there could be a delay because of ‘local holidays‘.

Related Guides in this Section:

Child Tax Credit Payments 2022

HMRC Tax Credits Calculator 2022/23

Tax Credit Overpayment Helpline

Working Tax Credit Entitlement and Eligibility

Tax Credits Payments Scotland

When tax credit dates fall on traditional days off for most of the working public, they are usually paid early if the due dates fall on official public holidays.

Even so, some tax credit bank holiday payments in Scotland and Northern Ireland may be paid later than the regular due date.

- Edinburgh: A local holiday falls on Monday the 19th of September.

- Glasgow and Aberdeen: A local holiday falls on Monday the 26th of September.

- Dundee: A local holiday falls on Monday the 3rd of October.

Note: Your bank may be able to provide further information on when the extra tax credit payment will go in and clear in the account.

Manage Your Tax Credits Online

Information in this section explains how to update your details with HM Revenue and Customs (HMRC).

You should always inform the Tax Credit Office about any changes affecting tax credits (e.g. you changed your working hours or got married). You can also calculate how much you will get paid and when.

Check Tax Credits Payment Online

Setting up a personal tax account with HMRC has several benefits. You will be able to check the amount of your next tax credits payment and how often you will get paid.

Click here to use HM Revenue and Customs service to manage your tax credits on the GOV.UK website. If this is the first time you sign in, you will need:

- A permanent National Insurance number (i.e. not a temporary one).

- A Government Gateway account (you will already have one if you used HMRC online services before).

You will need to prove your identity using one of these documents as proof. Choose between your:

- Bank account details

- P60

- Three (3) most recent payslips

- Passport number and expiry date

The process of signing in also activates your personal tax account. So, you can use the same service to check and to manage your HMRC records.

Note: You must renew your tax credits before July the 31st in the current tax year. A guide explaining how to manage your tax credits is also available in Welsh language (Cymraeg).

Renewing Your Tax Credits

The information in this help guide explains how to renew your tax credits claim. Further details clarify the application deadline, how the renewal pack works, and how long the process it takes.

People who claim tax credits will receive a renewal pack in the post. It explains how the process of renewing tax credits works.

People who claim tax credits will receive a renewal pack in the post. It explains how the process of renewing tax credits works.

Check if your renewal pack has a red line across the first page stating “reply now”. If so, you must renew no later than 31st of July.

Missing the deadline means your tax credits payments will stop. You would receive a statement and would need to pay back the amount received since the 6th of April (in the current tax year).

HM Revenue and Customs (HMRC) will send you ‘provisional’ payments (estimated) from the 6th of April until you have renewed your claim.

Information given to HMRC from your employer or from your pension provider could change the amount you get.

Note: The HMRC guide explaining how to renew your tax credits is also available in Welsh language (Cymraeg).

When there’s No Need to Renew

The renewal pack might tell you to “check now”. If so, providing your details to are correct, there is no need to do anything. HM Revenue and Customs will renew your tax credits by automatic process.

Anyone who first claimed tax credits after the 6th of April would not get a renewal pack until the following April.

Note: You must notify HMRC no later than 31st of July if anything in your pack is incorrect or your circumstances have changed. Failing to tell them means your tax credits could stop or you may need to pay a penalty.

You can renew tax credits:

You will find out how much you will get within eight (8) weeks of HM Revenue and Customs receiving your renewal.

You will need:

- Your renewal pack (contact HMRC if you do not get it by the 21st of June).

- Your NINo (National Insurance number).

- Details about any changes that affect your tax credits.

- Total income for the last tax year (6th of April to the following 5th of April) for you and your partner.

- The 15-digit renewals reference number found on the renewal pack (when renewing by phone).

Note: The short video from HM Revenue and Customs [3:26 seconds] has more advice about managing tax credits renewals.

We hope you found the information you were looking for on early tax credit payments 2022. You will find even more answers to popular questions in the main section of our guide to tax credits 2022/23