STOP CLAIMING TAX CREDITS: The UK Government is shaking up the benefits system.

Universal Credit is the new buzz word for many claimants. The Universal Credit roll out replaces tax credits, Housing Benefit, and others.

But, you cannot claim for UC at the same time as certain other welfare benefits. That means your tax credits award ends if you start:

- Claiming for Universal Credit (or your partner does).

- Living with your partner who has made a claim to get Universal Credit.

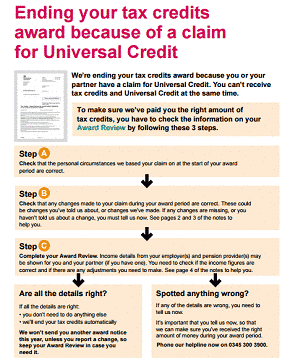

HM Revenue and Customs send out an ‘award review‘ letter to those who apply for Universal Credit. This is the process that will end your tax credits award.

Note: The award review is not the same document as used for your normal tax credits renewal letter.

In these cases you need to check and confirm your current personal details and your income. Working out your income amount will depend on your situation. The process has different applications for employed workers and those who are self employed (see below).

Paying Back Tax Credit Overpayments

Your award review letter informs you whether a tax credits overpayment needs paying. A similar letter could also get sent out at a later date if you:

- Reported a change in circumstance on your award review.

- Needed to make an ‘award declaration‘ (e.g. by those who start working for themselves).

Owed repayments get taken from your Universal Credit repayments. They will inform you of the start date if this happens.

When You Cannot Claim Universal Credit

Universal Credit is not available for everyone who may be ending tax credits claim. You will not qualify for UC if any of these apply:

- You are not living in a Universal Credit zone.

- You qualify for Pension Credit instead (or your partner does).

- You have at least 3 children.

Note: The tax credits claim may still end in some cases even when you cannot get UC. In this case, you would need to opt out of tax credits (cancel it) and then make a new claim.

Award Review: Your Personal Details

The award review letter includes guidance notes. It will help you through the process of ending your tax credits award. Read through the guide before you confirm your personal details, which will be:

Whether you claim tax credits by yourself or you make a joint claim with a partner.

Whether you claim tax credits by yourself or you make a joint claim with a partner.- Your full address.

- Whether you have a disability.

Where appropriate, you may also need to confirm whether any of these circumstances apply:

- You are responsible for any children (under 16 years old).

- You are responsible for any children between 16 and 20 years old in full-time education or approved training (up to NVQ level 3).

- Any of the children get benefits (e.g. DLA or PIP).

- There were any certified blind children within 28 weeks of your claim (or any claims for blindness ended).

- You have any childcare costs for tax credits.

Note: You will also need to verify any income received from self-employment, employment, and any other benefit claims.

Ending Tax Credits Claim: Employed or on Benefits

Income applies to those who get paid wages or salary through Pay As You Earn or from benefits. Even so, income confirmation is only needed for the ‘award period‘.

As a rule, the award period runs from the 6th of April of the current tax year to the date you stop claiming tax credits. Make sure any tax credits changes, and your income for your award period, are all correct.

Note: This is not your tax credits renewal letter. The guide you get with the award review will help you confirm your income.

Working Out Your Total Income

Prepare this information when you confirm your total income. They will want to know:

- About any income you get from any paid employment.

- Whether you get income from your pensions (including the basic State Pension).

- Whether you get income from self-employment.

- About any other source of income (including any savings or rental income).

- Whether you get some other taxable benefits.

Award Period Deductions

You can make some deductions during your award period. Check the deductions and amounts against your award review letter after working out your income. You can deduct:

- Payments to an annuity or registered personal pension schemes.

- Donations made to a charity where Gift Aid got applied.

Stop Claiming Working Tax Credits When Self-employed

In this case, you would need to calculate your ‘award period‘ income from being self-employed. As a rule that runs from the 6th of April of the current tax year to the date you stop claiming tax credits.

You must add in the details of any other earnings you get your ‘award declaration‘. This is the confirmation of your income that you send to HMRC. It includes any taxable benefits or pension payments.

Working Out Your Total Income

In some cases, you can use the part-year profit calculator for working out income for an award period. The part-year profit calculator is useful when you do not have full year accounts.

The HMRC work sheet also helps you calculate your daily rate. Then you need to multiply that by the number of days in your tax credits award period. To work out your total income you will need to know:

- The exact dates for the accounting period ending in the tax year that you start claiming Universal Credit. This is usually the 6th of April to following 5th of April for those in self-employment.

- Your actual profit (or estimated) for that particular accounting period (HMRC may need to see how you worked out estimated profits).

- The total number of days in your accounting period (usually 365).

- The number of days may be different if you recently started (or stopped) being self-employed, changed your accounting dates. or it occurs during a leap year.

Details of Other Income

Include all the details of other income you received while you claimed tax credits in this tax year. That means you must include any interest that you got from savings, an annuity, or a pension.

Deduct £300 from the total amount before tax. Enter the number ‘0’ (zero) if this leaves you with a minus figure. You do not need to include any maintenance payments or student grants or student loans.

Award Period Deductions

You can make some deductions during your award period. Check the deductions and amounts against your award review letter after working out your income. You can deduct:

- Payments to an annuity or a registered personal pension scheme.

- Donations made to a charity where it applied Gift Aid.

What happens if you made a loss? If you make a loss or expect to make a loss, you can:

- Enter the number ‘0’ (zero) as your self-employed income when you submit your ‘award declaration’.

- Deduct the loss from any other income you (or your partner) accrued.

You must report your income to HM Revenue and Customs on your ‘award declaration’ after you work out your income.

Changes to Income or Personal Details

You must report any changes when you end your claim for tax credits. You may already have reported them. You will need to repay any tax credits overpayments. This could happen if HMRC discovers information on the award review was either incomplete or incorrect.

Final Steps to Close Tax Credit Claim

Telephone the Tax Credits Helpline within 30 days if any of your details are incorrect or incomplete. HMRC will help you correct your details and inform you of what happens next.

Reporting self-employed income means you must send your ‘award declaration‘ to HM Revenue and Customs.

Note: There is nothing left to do providing a) the details on your award review are correct b) you have no employed or self-employed income to report.

In some cases there will be a gap between the time of ending tax credits claim and the start of Universal Credits payments. You may be eligible for an advance on the first UC payment if:

- You were recently receiving another benefit.

- Your circumstances show you need urgent financial help.

Note: Contact your Jobcentre Plus work coach for further information on the advance payment process.

Income from Self-employment

Use the ‘statement of earnings‘ form to report your income every month if you get Universal Credit.

Claiming other Benefits Entitlement

Universal Credit will replace several benefits including:

These benefits will stop if are successful in claiming Universal Credit. You will receive Universal Credit payments instead. Any other benefits you get will continue in the usual way.