MAKE A SORN ONLINE: There are several reasons for declaring a car off the road with the DVLA.

In most cases, it will be because you are storing the vehicle in a garage or on your driveway.

The most common reason is to remove the need to pay vehicle tax (VED). But, you must not use it on the road again unless you have taxed it.

You need to inform the Driver and Vehicle Licensing Agency in Swansea. They are responsible for vehicle excise duty and road tax registration.

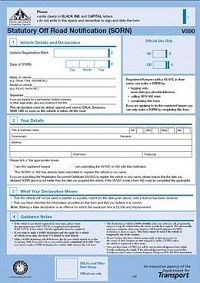

This information clarifies how to declare your vehicle off the road to DVLA. This process of vehicle status is often referred to as making a ‘Statutory Off Road Notification’ (SORN Certificate UK).

After you make a SORN there could be a road tax refund due for any full months remaining. But, remember if you claim the tax refund you must not use the vehicle on a public road until you ‘re tax a car after SORN‘.

Note: If you are from Wales check here to ‘Cofrestru eich cerbyd fel oddi ar y ffordd (HOS)‘ as it is the same page in Welsh language.

DVLA: Choosing the SORN Start Date

You will need the reference number (16 digits) on your vehicle tax V11 reminder letter or car tax renewal letter. The number should show only 11 digits on your log book (V5C) if you use this method.

SORN a Vehicle Online Now with DVLA

You can take your vehicle off the road immediately. Use the 11-digit number on the vehicle log book (V5C). Click through to the DVLA SORN website and tell them you are taking your vehicle off the road right now.

SORN a Car Next Month (first day)

What if you want to take your vehicle off the road from the first day of next month? In this case use the 16-digit number on your vehicle tax reminder letter (V11). Note that you can only use this number one time during the process.

Note: You will need to inform DVLA using the postal method if the vehicle is not registered in your name.

Make a SORN by Phone or Post

DVLA Vehicle Service

Telephone: 0300 123 4321

24-hour service

Find out about call charges.

Making a SORN by post means you will need to send an application form (V890) to DVLA in Swansea. Remember to inform them of which day you want to take your vehicle off the road. Using the post means it can be any day during the:

- Current month or the previous month: There will be no vehicle tax refund for past dates.

- Next month or the month after next month: Add a letter informing them why you need to delay it.

DVLA

Swansea

SA99 1AR

Register Vehicle SORN: Common Issues

- What if the address is wrong on the log book (V5C)?

- Write your new address on section 6 of your log book.

- Send a filled in ‘statutory off road notification (form V890)‘ and your log book to DVLA.

- What if the vehicle is not registered in your name?

- Fill in the appropriate part of the log book and send it with a filled in V890 form.

- What if you do not have a log book?

- Fill in the ‘apply for a vehicle registration certificate (form V62)‘ and send it with the V890 form to DVLA.

- The SORN declaration price is free of charge but the cost of getting a new log book is £25.

9 SORN Myths Busted by the DVLA

The Driver and Vehicle Licensing Agency clarified some of the common myths around SORN (Statutory Off Road Notifications rules).

1. Keeping a vehicle on the road is fine – but don’t drive it!

Wrong. If you SORN your car you cannot keep it on any public road. Thus, the vehicle must remain inside a garage, on the driveway, or on private land.

2. Motorists can transfer SORN to the next vehicle keeper

Much like not being able to transfer vehicle tax to the new keeper (e.g. if you sell your car), SORN is not transferable.

3. You must a SORN every year

Not true. After telling DVLA about a SORN there is no need to renew it annually. The SORN remains on the car until (or unless) you re-tax it, sell it, permanently export it, or it gets scrapped at a bona fide authorised treatment facility (ATF).

4. Driving a vehicle to MOT is illegal if it’s SORN

Myth. UK motoring laws allow you to drive a vehicle to a ‘pre-arranged MOT appointment‘ while it is under SORN.

5. Making a SORN is difficult and costly

Misconception. It only takes a few minutes to SORN a car online and it is free to do so. You can also get a vehicle log book (V5C) replacement if you need to get one.

6. I don’t pay tax on my EV so I don’t need a SORN

Fallacy. Being exempt from road tax means you still need to get it taxed. Thus, you need a Statutory Off Road Notification to take a vehicle off the road even if you do not pay for road fund licence (and then tax it before returning it to the road).

7. You can’t get a road tax refund if you SORN a vehicle

Incorrect. Registered keepers get vehicle tax refunds by automatic process for any full months that remain after making a SORN. So, keeping your address up to date with DVLA is important to get any refunds that are owing.

8. DVLA don’t let you make a SORN in advance

Not true. You can notify DVLA about a future SORN for a period of up to two (2) months in advance (e.g. online, by phone, or using traditional postal methods).

9. ‘UnSORNing’ a vehicle is a complicated process

Myth. Even though you cannot ‘unSORN’ a vehicle, taxing a car is simple to do once you are ready to tax it again.

Note: The main section explains when you might get a ‘DVLA last chance letter car tax‘ and how to avoid a hefty fine.